Credit cards offer convenience and flexibility, but they also come with terms and features that can sometimes be confusing. One such term is the “unbilled amount.” If you’ve ever checked your credit card statement or app and wondered what this means, you’re not alone. In this blog post, we’ll break down everything you need to know about unbilled amounts in credit cards, how they work, and why they matter.

What is an Unbilled Amount?

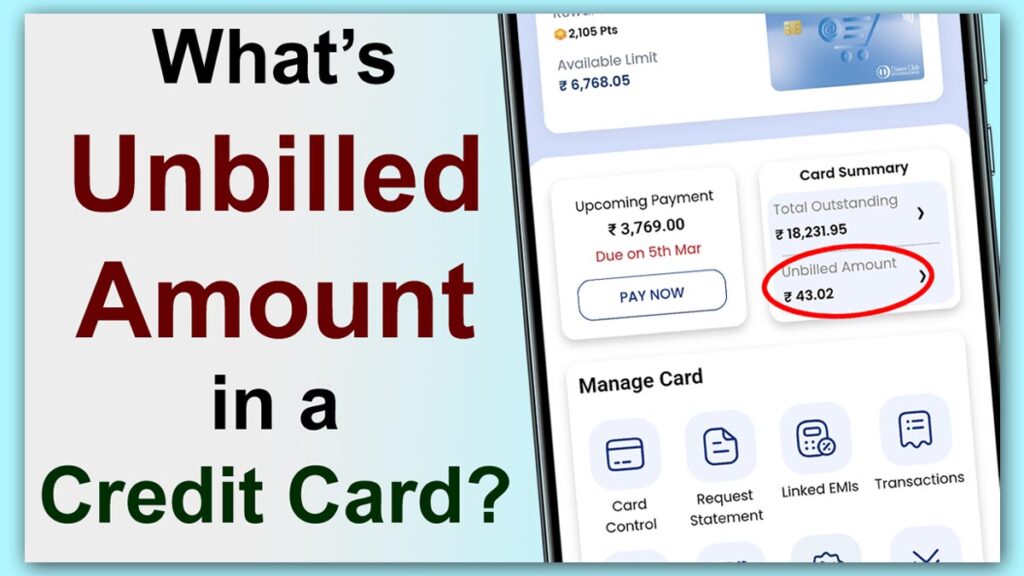

The unbilled amount on your credit card refers to transactions you’ve made that have not yet been included in your monthly credit card statement. These are purchases, payments, or charges that have been authorized but are still pending processing by the credit card issuer. Essentially, it’s the total of all transactions that have occurred after your last billing cycle closed.

How Does an Unbilled Amount Work?

Here’s a simple breakdown of how unbilled amounts work:

- Billing Cycle: Your credit card has a specific billing cycle (e.g., 30 days). At the end of this cycle, your statement is generated, and all transactions made during that period are billed.

- Unbilled Transactions: Any transactions made after the billing cycle closes but before the next statement is generated fall under the “unbilled amount.”

- Statement Generation: Once the next billing cycle ends, the unbilled amount will be included in your new statement, and the cycle repeats.

Read Also: How to Writing a Check

Example of Unbilled Amount

Let’s say your credit card billing cycle runs from the 1st to the 30th of every month. Here’s how it works:

- Transactions from January 1–30: These will appear on your January statement.

- Transactions from January 31–February 28: These will be part of your unbilled amount until the February statement is generated on March 1.

Why is the Unbilled Amount Important?

Understanding your unbilled amount is crucial for several reasons:

- Budgeting: It helps you keep track of recent spending that hasn’t yet been billed, giving you a clearer picture of your finances.

- Avoiding Overspending: Knowing your unbilled amount prevents you from exceeding your credit limit or spending beyond your means.

- Payment Planning: If you want to pay off your credit card balance early, you can include the unbilled amount to avoid carrying over any debt.

- Dispute Resolution: Monitoring unbilled transactions allows you to spot unauthorized or incorrect charges early and report them to your card issuer.

How to Check Your Unbilled Amount

Most credit card issuers make it easy to check your unbilled amount. Here’s how:

- Online Banking or Mobile App: Log in to your credit card account online or through the mobile app. The unbilled amount is usually displayed alongside your current balance.

- Customer Service: Call your credit card issuer’s customer service helpline to inquire about your unbilled amount.

- Email or SMS Alerts: Some issuers send regular updates on your unbilled transactions via email or SMS.

Should You Pay the Unbilled Amount?

you can pay your credit card unbiller amout, Paying your unbilled amount is optional but can be beneficial in certain situations:

- Avoid Interest Charges: If you pay the unbilled amount before the due date, you can avoid interest on those transactions.

- Improve Credit Utilization: Paying off unbilled amounts can lower your credit utilization ratio, which may improve your credit score.

- Stay Debt-Free: If you want to maintain a zero balance on your card, paying the unbilled amount ensures you don’t carry over any debt.

However, if you’re confident about paying the full amount when the statement is generated, you don’t need to pay the unbilled amount immediately.

Read Also: How to create multiple income streams

Unbilled Amount vs. Current Balance

It’s important to distinguish between the unbilled amount and the current balance:

- Unbilled Amount: Transactions made after the last billing cycle but not yet included in your statement.

- Current Balance: The total amount you owe, including both billed and unbilled amounts.

Tips to Manage Your Unbilled Amount

- Track Your Spending: Regularly monitor your unbilled transactions to stay on top of your finances.

- Set Payment Reminders: Use reminders to ensure you don’t miss payments, especially if you plan to pay off the unbilled amount.

- Use Alerts: Enable transaction alerts to get notified of every purchase made on your card.

- Plan Ahead: If you know you’ll have large unbilled transactions, adjust your budget accordingly.

Read also: how to create ATM Pin

Frequently Asked Questions (FAQs)

1. Is the unbilled amount due immediately?

No, the unbilled amount is not due immediately. It will be included in your next statement, and you’ll have until the due date to pay it.

2. Can I dispute an unbilled transaction?

Yes, if you notice an unauthorized or incorrect transaction in your unbilled amount, contact your credit card issuer immediately to resolve the issue.

3. Does the unbilled amount affect my credit limit?

Yes, the unbilled amount is part of your total credit utilization, so it affects your available credit limit.

4. Can I pay the unbilled amount before the statement is generated?

Yes, you can pay the unbilled amount at any time to reduce your balance and free up your credit limit.

Final Thoughts

The unbilled amount on your credit card is a simple yet important concept to understand. By keeping track of it, you can better manage your finances, avoid overspending, and maintain a healthy credit score. Whether you’re a seasoned credit card user or just starting out, staying informed about terms like unbilled amounts will help you make smarter financial decisions.

If you found this guide helpful, don’t forget to share it with others who might benefit. And for more personal finance tips and insights, stay tuned to Our Finance Boss!

Let me know if you’d like to tweak this post further or add more details!