What is NEFT Transfer ?

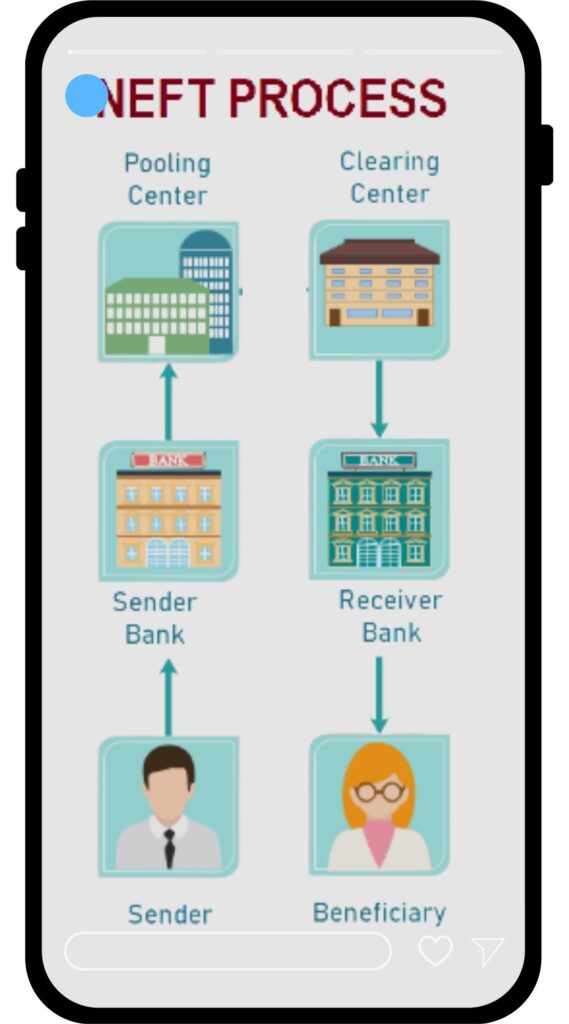

NEFT Stand for national electronic Fund Transfer. it is a digital payment system in india that enables the transfer of funds between bank electronically. NEFT allows individual and buisness to send money acros differnet bank account, making the more efficiennt and convenient.

Features

- Real-time transfer : Transfer are processed in batches, but transfer generally occour within a few house during working hours.

- 24/7 availability : In recent years, NEFT Transaction have become available round the clock, including weekends and holidays.

- No Upper or Lower Limit : There is no Set Limit for the amount you can send through NEFT, athrough individual banks may impose limits on the size of transfer:

- Secure Transaction : The system use encryption for secure transmission of data, ensuring that your money transfer is safe.

- Cost Effective : NEFT typically in involves lower, transaction fees compared to traditional methods, such as demand draft or wire Transfer.

NEFT is widely used for various types of payments. including paying bills, sending money to family or friends, and making buisness payments.

NOTE : January 2020, the reserve bank of India has instructed Bank not to charge any additional fees for online transaction through NEFT, this decision aims to promote digital transctions and provide users with a cost-effective and convienient method of transferring funds.

Information Requried To Transfer Funds through NEFT ?

it is widely used for various types of payments. including paying bills, sending money to family or friends, and making buisness payments.the necessary details for remitting to funds through NEFT include :

- Beneficiary’ Name

- Beneficairy’s Branch name

- Beneficiary’s Bank Name

- Beneficary’s Account Number.

- Beneficary’s Account type

- Beneficiary’s IFSC Code.

NEFT Timing

We have covered all major aspects of Using NEFT for banking Transactions. the NEFT time is 24/7 Hours and 365 Days A Year. You Can do NEFT Transaction Once you have added the Beneficiary details to Your Account. either Online or Offline

NEFT Limits

The RBI has not Set the limit on NEFT Transactions, However an Individual Bank May Set up limit on Your Account.

Maximum Charges

| Transaction Value | Maximum Fees |

| Up to Rs. 10,000 | Rs. 2.50 + GST |

| Rs. 10,000-1,00,000 | Rs. 5 + GST |

| Rs. 1,00,000-2,00,000 | Rs. 15 + GST |

| Over Rs. 2,00,000 | Rs. 25 + GST |

Conclusion : NEFT, or National Electronic Funds Transfer, is a fund transfer mechanism started by the RBI in 2005. It settles transactions in half-hourly batches. Organisations, companies and individuals can use it to transfer funds from one bank account to another. It is available 24/7 throughout the year.

What is the Limit of NEFT Per Day ?

The RBI has not Set the limit on NEFT Transactions, However an Individual Bank May Set up limit on Your Account.

You Can use NEFT Process for this work

No, all banks do not provide NEFT facilities. Most of the top banks provide NEFT facility in India.

It can take up to 2 hours for the beneficiary to receive the amount.