If you are an employee in India, you must have heard about EPF or Employees Provident Fund. It is a retirement savings scheme managed by the EPFO (Employees Provident Fund Organization). To manage your EPF account smoothly, it is very important to update your KYC (Know Your Customer) details.

In this blog post, we will explain how to upload KYC for your EPF UAN (Universal Account Number) in very easy steps.

What is KYC in EPFO ?

Here You will know about KYC in EPFO.

KYC stands for Know Your Customer. It means linking your important documents to your EPF account. This helps verify your identity and bank details.

- By updating KYC, you can.

- Withdraw or transfer your EPF easily,

- Get timely updates on your EPF account,

- Avoid delays in claim settlement,

Documents Required for EPF KYC

You will need the following documents.

- Aadhaar Card

- PAN Card

- Bank Account details (with IFSC code)

- Passport (optional)

- Driving License (optional)

- Voter ID (optional)

Note: Only Aadhaar, PAN and Bank details are mandatory for most of the services.

Steps to Upload KYC for EPF UAN.

How to Upload KYC Documents in EPFO ?

You can upload your KYC documents by following the steps given below.

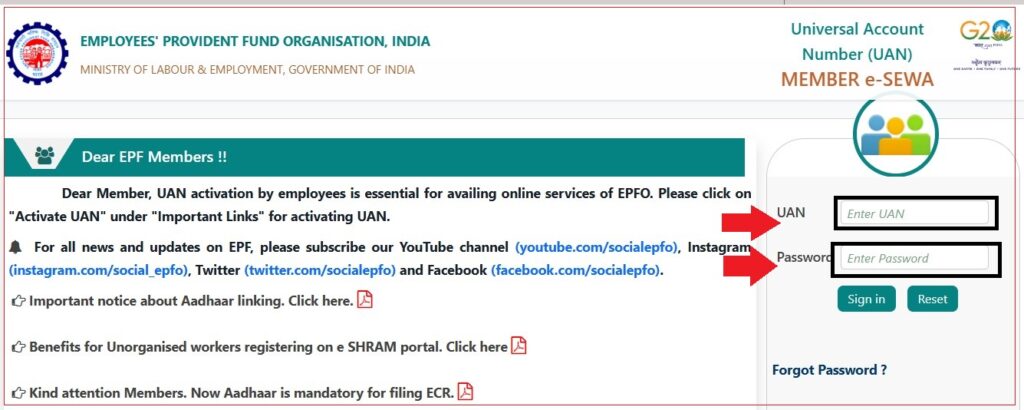

- First of all you go to epfo portal, for that click on the given link Click here.

- Now enter your UAN number and password, then enter the captcha and submit.

- Now go to the “Manage” option in the menu bar.

- Click on the ‘KYC‘ option from the drop-down menu.

- At this step, you will be redirected to a new page listing a variety of ‘Document Types’.

- Select the type of document (Bank, PAN, Passport) you want to update and click on the checkbox next to it.

- Enter the details of the document in the respective field. Like Aadhaar Card or PAN Card.

- After filling all the information click on “save”.

- After filling all the details correctly, you will see that you will see the “KYC Pending for Approval” column.

- Once approved by your officer, the status of KYC update will be shown under ‘Digitally Approved KYC’. You will receive a message once your officer approves your submitted documents.

Common Issues & How to Fix Them

| Issue | Solution |

|---|---|

| Name mismatch | Correct your name in Aadhaar/PAN or UAN |

| Invalid document number | Double-check and re-enter the correct info |

| Pending approval | Contact your employer or HR department |

how long does it take for kyc approval?

Generally, KYC documents are verified by your employer within 7 working days. Once verified, the status changes to “Approved by Employer” and “Approved by EPFO”.

Benefits of KYC verified EPF account

- Faster EPF withdrawal and transfer.

- Access to online claim services.

- Accurate interest credit and balance display.

- Decreased chances of fraud or account abuse.

Conclusion

Kyc in EPFO is a very important step to keep your PF account safe and active. It helps you get your money without any delay and use all online services easily. So if your KYC is not done yet, complete it today and stay tension-free.

Our Other Posts

- PM SVANidhi: Boosting Financial Independence for Street Vendors

- Bihar Laghu Udyami Yojana | Get 2 Lakh Loan Easily.

- Oriental Insurance Policy Download : Get Your Policy Anytime.

- National Insurance Policy Download: Access Your Coverage.

#epfo #kyc #pf