Creating multiple income streams is a powerful way to achieve financial stability and freedom. With the right strategies, you can diversify your income sources, reduce dependence on a single job or business, and increase your financial security. Here’s a detailed guide on how to create multiple income streams:

1. Understand the Importance of Multiple Income Streams

The concept of multiple income streams revolves around the idea of generating income from several different sources, such as jobs, businesses, investments, or side hustles. The goal is to reduce reliance on a single source of income. Here’s why it’s crucial:

- Diversification: Reduces the risk of financial loss if one income source stops.

- Increased Earnings: Allows you to earn more and boost your savings or investments.

- Financial Freedom: Gives you more control over your financial future.

2. Types of Income Streams

Income can be broadly classified into active and passive streams.

Active Income

Active income requires your time and effort, such as working a job or running a business.

- Job Income: Salaries, wages, or hourly payments from employment.

- Freelancing: Offering services like writing, web design, consulting, etc.

- Side Hustles: Selling handmade goods, offering tutoring services, or driving for ride-sharing services.

Passive Income

Passive income generates money with minimal active effort once set up.

- Investments: Stock dividends, bonds, mutual funds, or real estate.

- Online Courses: Create educational content once and earn money as people purchase or enroll.

- Affiliate Marketing: Earn commissions by promoting products through a website, blog, or social media.

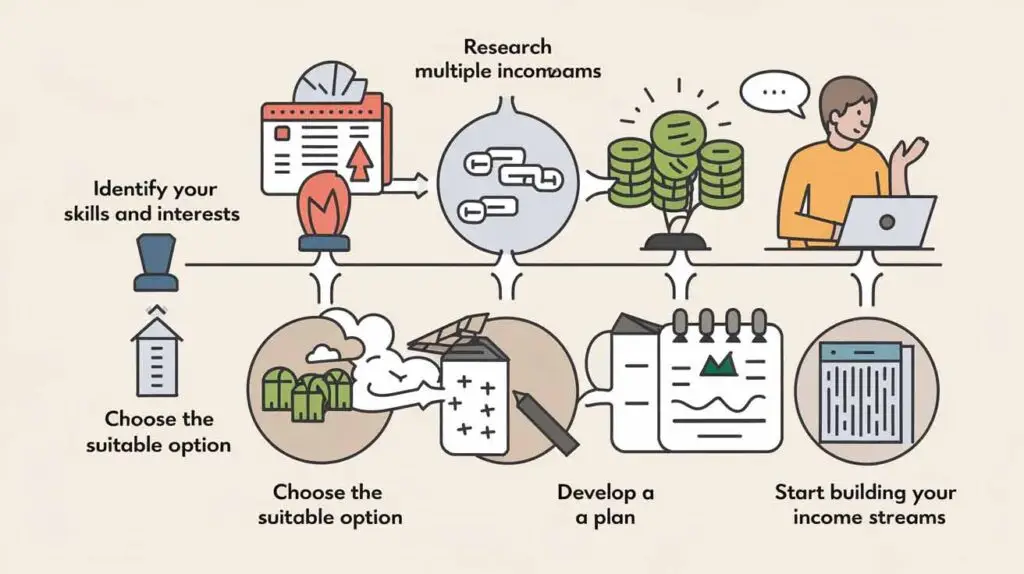

3. How to Create Multiple Income Streams

Here are actionable steps you can take to create multiple income streams:

A. Start with Your Primary Source of Income

Start by maximizing your primary job or business. Ensure that you are earning as much as you can and are efficiently managing your expenses. Once you have a solid foundation, move to the next steps.

B. Explore Freelancing and Consulting

If you have specific skills, consider freelancing or consulting in your area of expertise. Websites like Upwork, Fiverr, and LinkedIn can help you find clients for web development, graphic design, marketing, content creation, and more.

C. Invest in Stocks and Bonds

Investing in the stock market or bonds can provide you with passive income. Consider dividend-paying stocks or mutual funds that offer regular payouts. You can also invest in ETFs (Exchange Traded Funds) that allow you to invest in multiple companies with a single purchase.

D. Create an Online Business

Building an online business is an excellent way to create another income stream. You can start an eCommerce website, an affiliate marketing site, or a blog.

- eCommerce: Selling physical or digital products through platforms like Shopify or Etsy.

- Affiliate Marketing: Promote third-party products or services and earn commissions.

- Blogging/Vlogging: Share knowledge or experiences on platforms like WordPress or YouTube. You can monetize through ads, sponsorships, and affiliate marketing.

E. Real Estate Investment

Real estate can generate significant passive income through rental properties or flipping houses. You can start small by investing in affordable properties or through REITs (Real Estate Investment Trusts) that allow you to invest in real estate without owning physical property.

F. Create and Sell Online Courses

If you have expertise in a subject, you can create and sell online courses. Websites like Udemy, Teachable, and Skillshare allow you to upload your courses and earn money as students enroll.

G. Peer-to-Peer Lending and Crowdfunding

Peer-to-peer lending platforms like LendingClub and Prosper allow you to lend money to others in exchange for interest payments. Similarly, crowdfunding platforms like Kickstarter can help you raise funds for a business idea in exchange for equity or future products.

4. Time Management for Multiple Streams

It’s essential to efficiently manage your time while juggling multiple income streams. Here are some tips to stay organized:

- Set Clear Goals: Prioritize your income streams based on profitability and ease.

- Outsource Tasks: Hire assistants or use automation tools to manage tasks like social media posting or bookkeeping.

- Work Smart: Allocate time for each stream without overworking yourself.

5. Tips for Maintaining Multiple Income Streams

- Track Your Earnings: Use spreadsheets or financial apps to monitor all income sources.

- Focus on Quality: Never compromise the quality of your work, as it could hurt your reputation and income potential.

- Reinvest Profits: Invest the profits from your multiple income streams back into your business or investments to accelerate growth.

6. Example of Multiple Income Streams in Action

Here’s an example of someone successfully implementing multiple income streams:

- Full-Time Job: Works 9 AM to 5 PM as a software engineer.

- Freelance Consulting: Offers website development services on the weekends.

- Blog: Runs a blog about tech tutorials and earns through ads and affiliate links.

- Stocks and Bonds: Invests in stocks and bonds for passive income.

By combining these streams, this individual is able to build a diverse and stable financial foundation.

Conclusion

Creating multiple income streams is a highly effective way to secure your financial future. It may take time to build, but the rewards are worth the effort. Start small, stay disciplined, and gradually scale your income sources. Diversifying your income not only reduces financial stress but also empowers you to reach your goals faster.

#ourfinanceboss #multipleincomestreams

Pingback: How to Open A Bank Account - OUR FINANCE BOSS

Pingback: Top 5 Online Buisness You Should Start - OUR FINANCE BOSS