which is a form filed by an individual or entity with the tax authorities to report their income, expenses and taxes paid. It allows the government to assess the financial position of the taxpayer and determine whether they owe additional taxes or are entitled to a refund. ITR Filing is mandatory for tax payers and ensures compliance with tax rules. in this article we learn about how to ITR Filling Last Date FY 2024-25.

Read this also : Coin Market Cap : Crypto Tracker

When is the last date to File ITR ?

Read this also : Union Bank Account Opening : A Step By Step Process

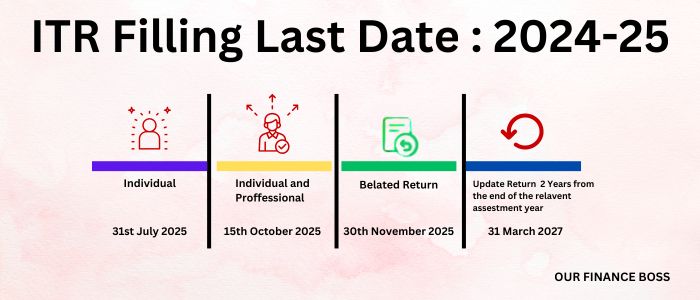

For the Financial Year (FY) 2024-25 (Assessment Year 2025-26), the ITR Filling Last Date FY 2024-25 in India are as follows:

31st July 2025: Deadline for individuals and Hindu Undivided Families (HUFs) not requiring an audit.

15th October 2025: Deadline for businesses requiring an audit.

30th November 2025: Deadline for businesses requiring transfer pricing reports.

Read this also : 0 Balance Account Open in HDFC Bank

Income Tax Filing Due Dates for FY 2024-25

Here are the key dates for ITR Filling Last Date FY 2024-25 in India:

For individual taxpayers (salaried individuals, freelancers and other individuals)

- Due Date: 31st July 2025

- This is the last date for filing ITR for individuals who do not require an audit (i.e., salaried taxpayers, freelancers, etc.).

For businesses requiring an audit

- Due Date: 31st October 2025

- This applies to taxpayers (businesses or professionals) whose accounts are required to be audited under the Income Tax Act.

For Taxpayers Requiring Transfer Pricing Reports

- Last Date: 30 November 2025

- This is the last date for businesses and individuals who are required to submit transfer pricing report under section 92E of the Income Tax Act.

For Revised and Updated Returns

Last Date for Filing Revised ITR:

- You can file a Revised Return within 24 months from the end of the relevant assessment year, which means the due date for revised returns for FY 2024-25 would be 31st March 2027.

Last Date for Filing Updated Return:

- Under the updated rules, you can file an updated return within 48 months from the end of the relevant assessment year. So, the last date for filing an updated return for FY 2024-25 would be 31st March 2029.

Important Notes

- Late fees/penalties: If you miss the last date, you may be charged a late fee under section 234F, which can range from ₹1,000 to ₹10,000 depending on the delay.

- Interest on tax due: If any tax is due and not paid by the due date, interest may apply under section 234A.

Additional Tips

- File taxes early to avoid last-minute mistakes and penalties.

- Keep your documents safe for reference in case of a tax audit or investigation.

Frequently Asked Question (FAQ)

1. Individuals with income above the basic exemption limit (Rs 2.5 lakh for individuals below 60 years of age) must file ITR.

2. Businesses and professionals with income above the limit must file ITR.

3. Even if your income is below the taxable limit, you may have to file ITR if you have outstanding taxes or want to carry forward losses.

31st July 2025 for individuals who do not require an audit.

31st October 2025 for businesses that require an audit.

30th November 2025 for businesses requiring transfer pricing reports.

Late filing can lead to penalties, interest on taxes due, and possible legal consequences if the delay is too long. It is always advisable to file taxes on time to avoid hassles.

yes Your can file your ITR by Click here Website.

Conclusion

Filing Income Tax Returns (ITR) is an essential obligation for taxpayers to ensure compliance with tax laws. It helps in paying the correct tax, claiming refunds and avoiding penalties. Filing ITR on time and correctly not only reflects financial transparency but also promotes responsible citizenship. Staying updated with tax filing deadlines and requirements contributes to overall economic health.

Salaried individuals and others: July 31, 2025

Taxpayers with professional audit: October 31, 2025

Transfer pricing cases: November 30, 2025

#ourfinanceboss #incometaxreturn #tax